Chloe Zhu, Sijing Chen, Yutong Miao (listed in no particular order)

Phumzile Mlambo-Ngcuka, the first female Deputy President of the Republic of South Africa, once said, “We still live in a world where the majority of poor people are women. We even say that poverty has the face of a woman.”

Female poverty is more severe and insurmountable than that of men. According to the United Nations, until 2022, 388 million women worldwide will live in extreme poverty, 16 million more than men.

In China, the multidimensional relative poverty rate (*Multidimensional poverty assesses people’s poverty from different dimensions, including income, education, health, etc.) of rural women is 27.3%, higher than that of rural men, which is 21.8%. Different dimensions of poverty interact with each other and trap many women in the cycle of poverty.

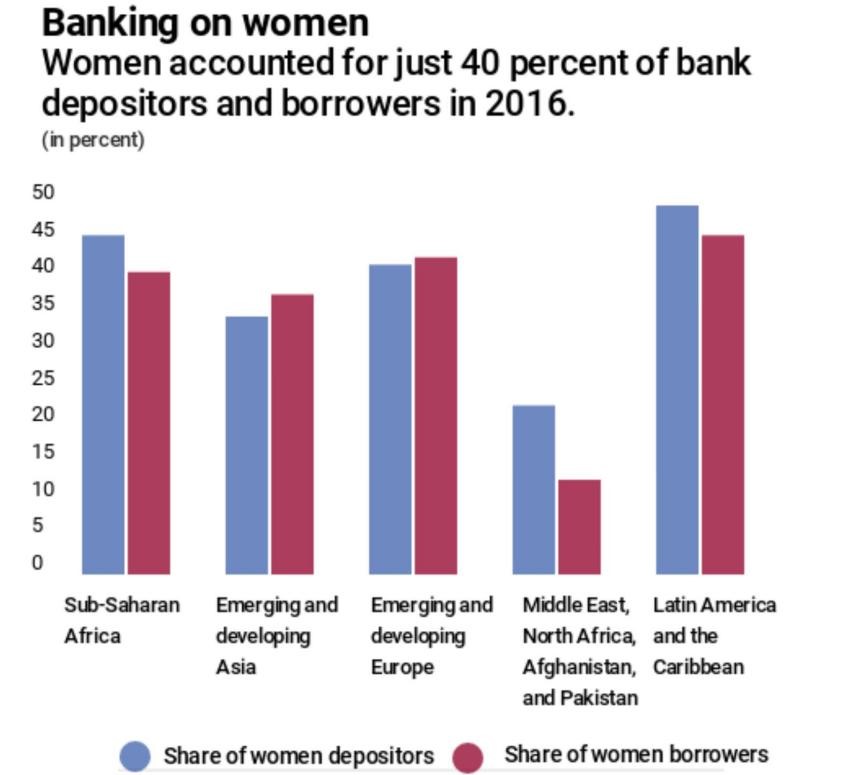

More and more women start their businesses to get out of poverty. But they are greeted by the first stumbling block on the road to entrepreneurship – access to finance. For years, poor women have been an audience group excluded by traditional banks from financial services such as loans.

A 2020 study showed that women in Chile were nearly 18 percent less likely than men to have their loan application approved, even though Chile is a country that has made some gains in improving women’s education and economy.

Thankfully, as microfinance is introduced and promoted, more women can empower themselves through these financial services.

Microfinance Empowers Women

The Grameen Bank in Bangladesh is an example of empowering women through microfinance. It was initially designed to provide affordable financial services to poor women.

With the provision of microfinance at its core, Grameen hopes to improve the lives of underprivileged women and drive socio-economic development by helping them with affordable financial services. Grameen’s model has several key elements.

First, Grameen focuses on poor women, especially those in rural areas. Grameen helps them to increase their incomes by providing microcredit for small-scale business activities, such as agriculture, handicraft production, and the sale of household goods.

Grameen’s microloans also do not require collateral. This is especially important for the poor, who are often unable to provide the collateral required by traditional banks. “We want to make loans that even beggars can join,” said Mr. Gao Zhan, President of Grameen China.

At the same time, Grameen utilizes a unique community model known as the “Group of Five.” Before officially joining Grameen, each borrower must form a group with four other borrowers to support each other and monitor each other’s repayment. This community model not only increases the borrower’s motivation to repay but also builds a community support network for the borrower.

The Grameen model has since been replicated in 41 countries, including Australia, India, and Uganda.

The microfinance model proposed by Grameen has also been promoted and upgraded around the world. In 1984, the economist John Hytch came up with the idea of a “Grameen bank” in Bolivia, hoping to enable poor farmers without collateral to obtain loans through collective guarantees. Later, John founded the International Community Assistance Foundation (FINCA), which set up village bank projects in Mexico, Honduras, and Guatemala.

Empowering women is part of FINCA’s vision, and they have developed a range of financial products and programs specifically for women. As a founder, John is well aware of the importance of giving women access to financial services: “It has been proven time and again that increasing the income of poor mothers almost immediately improves their children’s diets and increases the likelihood that they will send their children to school.” When a child is educated, he or she has a better chance of getting out of poverty.”

Online platforms have made it easier for microfinance institutions to serve women. In 2005, Kiva, an international non-profit organization, was founded in San Francisco to reach people with financial services needs around the world through the Internet. Loans on the platform range from a few hundred to a few thousand dollars, with a minimum of $25.

Kiva has provided $2 billion in loans to 4.8 million people in 80 countries, with more than 80 percent of loans to women and an average repayment rate of 96.3 percent.

Ankang entrepreneurial women facing problems

In 2019, to support female entrepreneurship, Grameen cooperated with banks to launch a micro-loan service of “Female Entrepreneurship Loan” in Ankang, Shaanxi Province. However, women entrepreneurs face multiple challenges.

First of all, the education level of some small and micro-entrepreneurship women in Ankang is not high, and the relevant skills are limited. “A lot of our female clients don’t even know how to write their names, so we teach them how to write and label their names over and over again.” Lu, Grameen Ankang’s manager, said. These women also have limited knowledge of financial literacy. Before joining Grameen, Ms. Chen, who owns a supermarket, knew little about borrowing and even what interest and collateral were.

In addition, some women have limited access to resources in the early stages of entrepreneurship. Many people do not have family support at the beginning of their business. Ms. Xu, the furniture store owner, first joined Grameen because her family did not support her business. “Taking this step (of starting a business) is very difficult at first; there is no support for you. They don’t support you financially, and they don’t support you spiritually.” Ms. Xu said.

Ms. He was also hampered in the early stages of her venture. She initially wanted to open a beauty shop out of personal interest, but her relatives were not optimistic, believing that opening a shop during the epidemic was not a wise choice. Later, Ms. He’s business prospered, and only then did she gain an understanding of her family. This family pressure will affect the confidence and determination of female entrepreneurs, making them feel lonely on the road to entrepreneurship.

Finally, many women entrepreneurs face a lack of funding. At the beginning of the business, they often do not have much savings, and it is difficult to raise start-up capital. In addition, unexpected situations (such as the epidemic) may lead to difficulties in capital turnover, increasing the financial risks in their entrepreneurial process. Ms. He revealed that she had borrowed money from friends and loan sharks and finally managed to scrape together 60,000 or 70,000 yuan of start-up funds.

Ms. Liu, who runs the hotel, used to be a “white household” with no loan record, so most banks are reluctant to give them loans, making it more difficult for them to obtain funds. “Relatives and friends have borrowed, but like us, white households, no assets, go to the big bank loans are not to give loans.” Ms. Liu said.

Grameen’s present situation and challenges

Today, Grameen has grown to 817 members and granted more than 1,000 loans.

Once the loan interest is confirmed, Grameen’s center manager sets up a group for female members and introduces them to the Grameen loan process during training. Once the loan is distributed, members are required to repay the loan through a weekly center meeting.

Grameen supports women entrepreneurs through funding, training, and networking opportunities.

“I think Grameen, a platform that provides entrepreneurial capital for women, is a support for women. Many women are influenced by their husbands and children at home, and they can’t do it if they want to. So Grameen’s support for women is great.” Ms. Chen, who started selling thick liquor in 2016, affirms, “Grameen not only provides support for women in terms of start-up capital but also helps women spiritually.”

Although the loan amount is not large, the money is crucial for some families. “For many merchants, no matter how high the revenue is, sometimes 20,000 or 30,000 yuan may be the last straw that crushes a camel because her entire family’s income is pressed on this store.” Grameen Ankang’s manager Li said.

In addition to financial support, social networks between members and managers and among members under the Grameen model are also important for women entrepreneurs.

“When she encounters any scam calls, she will immediately think of our center managers and call me.” Manager Lu said. Because of the long-term interaction, the members have a lot of trust in the manager.

Members also care for each other and take care of each other’s business.

On a street at the north gate of Ankang New Town, Ms. Chen runs a restaurant. On weekdays, she also keeps in touch with other group members: “One member sells water pipes, and sometimes I need to buy pipes here. I also often meet with members of the noodle shop in the neighborhood, and when we see each other, we greet each other, and when we are not busy, we will stand there and say a few words. Sometimes when I made sauerkraut, I asked her to scoop it up. ”

Ms. Chen, who runs a supermarket, also expresses: “After the loan, I talked with the group members in the meeting, and the more contact with people around, I knew how to run the business. ”

However, there are still some challenges to the promotion of the Grameen model in Ankang.

First of all, the acceptance of the Grameen model by some members still needs to be improved. Ms. He believes that the loan amount of 30,000 yuan will not support her to expand her store, and she hopes to have a higher loan amount. Some members want to be able to adjust the way they make their weekly payments. “Sometimes I can’t participate in group meetings when I’m out of town, and that’s inconvenient. Because missing the meeting will make my records be “crossed,” which will also affect my future loans,” Ms. He said.

Secondly, Grameen still has no financial license in China, so it has to work with other financial institutions, and it is difficult for Grameen to fully replicate its experience in Bangladesh.

Mr. Gao Zhan, President of Grameen China, said: “In Bangladesh, beggars can become members of Grameen Bank, and there is a very high repayment rate. In addition, members can get a loan immediately after training. But in Ankang, Grameen’s clients must show a self-employed business license and also make a credit report. Sometimes, it takes up to two months for the loan to be distributed. ”

From this point of view, Grameen China can only “embrace the financial untouchable” within limited conditions.

Despite this, Grameen China is also trying to find breakthroughs and development opportunities. “I recently accompanied a commercial bank to the Grameen in Bangladesh. Happily, they are willing to design credit products based on Grameen’s basic model to serve the most vulnerable people,” Gao Zhan shared excitedly.

“To see, to socialize, to connect, that’s the core of Grameen.” This golden sentence expresses the essence of microfinance to empower women, and “embracing the untouchable in the financial world” is the spiritual core of this model. In the future, Grameen China will finally break through the predicament and help more women bask in the sunshine of sustainable development.

References:

1.https://news.un.org/zh/story/2022/09/1108931

4. Do Women in China Face Greater Inequality than Women Elsewhere? | ChinaPower Project (csis.org)

5. Has China lifted 100 million people out of poverty? – BBC News

7.https://blogs.iadb.org/ideas-matter/en/how-gender-discrimination-stops-women-from-getting-loans/https://www.kiva.global/gender-focus/