Sijie Chen, Jiayi Xiao, Ziming Qiao, Xintong Hou, Chenxi Wei

“At that time, my child was in high school and going to college soon, so I wanted to start a business to make some money,” said Ms. Deng, who opened a steamed noodle shop in Ankang, Shannxi. Nowadays, more and more women in China’s underdeveloped cities are trying to develop and get rid of poverty. According to the report called “The Vitality of Youth Startup Cities” jointly released by China Youth Daily, Tian Yan Cha, and Qing Chuang Tou Tiao, more than 44 million new startups were created in China from 2011 to 2020, of which 44.6% were female entrepreneurs.

As a bank with more than 97% of its borrowers being women, Grameen can be regarded as a “women’s bank.” Grameen Bank was officially established in Bangladesh in 1984. It was established to provide financial services, such as microfinance, to people at the bottom of society and to help them completely escape poverty through entrepreneurship. Among such people, women make up the majority.

Now, the Grameen model has been replicated in 41 countries around the world, including China. Grameen China was officially established in Lukou, Jiangsu Province in December 2014, and landed in Ankang, Shaanxi Province in July 2019. So far, the Grameen Ankang has issued more than 1,000 loans, supporting more than 800 women to realize their entrepreneurial dreams.

How Grameen Ankang supports female entrepreneurs

Grameen provides comprehensive support to female entrepreneurs. First, Grameen offers micro-credit loans to female entrepreneurs to solve their liquidity problems. Those loans vary from 10,000 RMB (1,386 USD) to 30,000 RMB (4,160 USD), accompanied by an extremely low interest rate.

Most of the female entrepreneurs faced liquidity problems when they found Grameen. Mrs. Dang, who just rented a place to open her hardware store, was in need of money. Hardware stores require owners to order an excessive amount of product since owners must make sure they always have enough stock. One of the Grameen managers met Mrs. Dang and offered her this opportunity. She was thrilled to accept it. She admitted that Grameen’s low interest is what makes it stand out.

Besides Mrs. Dang, Mrs. Deng also mentioned the benefits of micro-credit loans. Mrs. Deng’s steamed noodle store was opened in 2017. In 2020, when the Grameen managers visited her store, she was facing a minor liquidity problem. After a renovation of the store and their house, her daughter was also entering high school. Everything needed money to operate. She started with a 20,000 RMB(2,772 USD) loan for purchasing ingredients and borrowed a loan of 30,000 RMB for the second time. Grameen was a great fit for her since she was not seeking a huge loan. All she needed was money to keep her store operating and purchase some ingredients.

Also, Grameen’s repayment cycle is once a week, which also spreads the pressure on members.

In addition, Grameen builds communities for female entrepreneurs and promotes them to participate in social activities.

One of the most distinct characteristics of Grameen is the five-person groups. Every member would be in a group with someone who lives close to them and around a similar age and repay the loans in weekly meetings. This meeting is also an opportunity for female entrepreneurs to meet people, learn from each other, and expand their social groups, especially for many stay-at-home mothers who have been isolated from society.

Additionally, group members can create mutual assistance within the group. “Members always help each other and introduce business to each other.” said a manager in Grameen Ankang. Mrs. Dang and other group members would share their thoughts and experiences on running a business, educating their children, and helping each other whenever groupmates need support.

Grameen members are not the only group of people who fell in love with this system; the managers’ working are also strong supporters of this system. “I choose this job because I can help stay-at-home mothers like me to meet new people and find a comfortable social group,” Mrs. Yin, a manager from Grameen Shenzhen, said. “There are many people in Shen Zhen, but it is so easy to feel alone because everyone is busy. It is hard to make deep connections.” this is why she loves her job.

The district manager from Lu Kou, Mrs. Zhu, completely agrees with Mrs. Yin. “The communication and connection between group members is the most important special factor of Grameen.” She further explained, “ The main ideology of Grameen is to help the ‘financially untouchables,’ it is good for them to gather up and communicate to someone in a similar situation; they need this little group.”

In addition to the five-person group system, Grameen organized many group bonding events. Mr. Ma, the district manager of Grameen Ankang, mentioned that he used to organize a tea party. “We had 200 members attending our tea party once.” Grameen also organizes events based on special festivals. Mrs. Deng still remembers an event held during the Dragon Boat Festival in 2021. She and other members of Grameen gathered and made Zongzi, a traditional Chinese food.

Finally, Grameen also helps its members develop good habits through weekly meetings and through establishing six decisions that encourage fundamental community and personal change.

Lots of members agreed that they have developed good habits in Grameen. For example, Mrs. Dang started taking all her family members to take an annual physical exam (which is the sixth decision) after she joined the Grameen program, and she continued till today. Mrs. Pang, who runs a five-year beauty shop, has developed a habit of saving money regularly. “Grameen asks members to repay the loan once a week, so I gradually became aware of saving and started saving money every week.”

What difficulties does Grameen Ankang face?

Despite Grameen Ankang’s positive impact on female entrepreneurs, the implementation of the Grameen model also faces some challenges.

Grameen China does not have a financial license, so it needs to cooperate with financial institutions to issue loans. In the process of collaborating with financial institutions, the replication of the Grameen model has been affected to some extent.

Firstly, cooperation with financial institutions prevents Grameen Ankang from screening target customers well. In Bangladesh, Grameen is looking for the exact opposite of customers than commercial banks. “Traditional banks lend money to the rich, Grameen lends to the poor; they lend to men, we lend to women; they are in the city, and we go to the countryside.” Professor Yunus said. In Bangladesh, Beggars can also get loans. Nevertheless, in Ankang, female entrepreneurs have to meet other requirements, such as a business license, to become a Grameen member. “I recommended Grameen to several friends before, but it failed in the end because she did not have a business license,” said Mrs. Chen, who sells homemade wine.

Additionally, partner institutions usually do not have financial products that perfectly match Grameen’s model, which affects Grameen’s service quality. Grammen. According to Grameen’s classic model, members can immediately obtain small loans after forming a group and undergoing a week of training. But when the qualifications are relaxed at the partner institution, it is up to them to decide when to disburse funds. “Because they are slow to lend money, our members are also relatively slow to form. There are only a few hundred to less than a thousand members a year. It is very difficult for our company.” A manager from Grameen Ankang said.

Despite the challenges, having sufficient partners is a guarantee for replicating the Grameen model in China. However, there are still only a few financial institutions willing to cooperate with Grameen.

Meanwhile, there are obstacles to Grameen’s internal operations. “A big obstacle at present is that it is difficult to recruit employees who have received Grameen training,” said Mr. Gao Zhan, who brought Grameen bank into China, “Forty years ago, Professor Yunus and his students founded the Grameen Bank in Bangladesh. This group of employees came from scratch, and they formed a very dedicated team. It is not easy to find such people in China. I have recruited some people with higher academic qualifications before, but they left quickly.”

According to Mrs Zhu, what Grameen Lukou needs most right now is to expand its team. Grameen’s project site in Lukou is self-operated on a farmer cooperative and does not receive financial support from any cooperative agency. Here, the main fund to maintain the operation of the project site is the interest collected on the mutual fund, and the team currently has insufficient personnel, so it is unable to develop a sufficient number of members. This limits the development of Grameen Lukou.

Grameen Ankang’s Development Path

Grameen in Ankang is still expected to achieve better development. Firstly, the promotion experience of Grameen in other regions is worth learning from. Lukou village is the hometown of Mr. Gao Zhan; he said that the operational model of Grameen Bank here is a complete restoration of Grameen Bank’s model in Bangladesh. They are not restricted by other partner banks, and they have a mutual fund pool that can be used to issue loans to female members. This also means that in Lukou village, female clients can quickly receive the loan as long as they complete the five-day training. Maybe in the future, the model of farmer coorperative can be replicated in more cities in China, including Ankang.

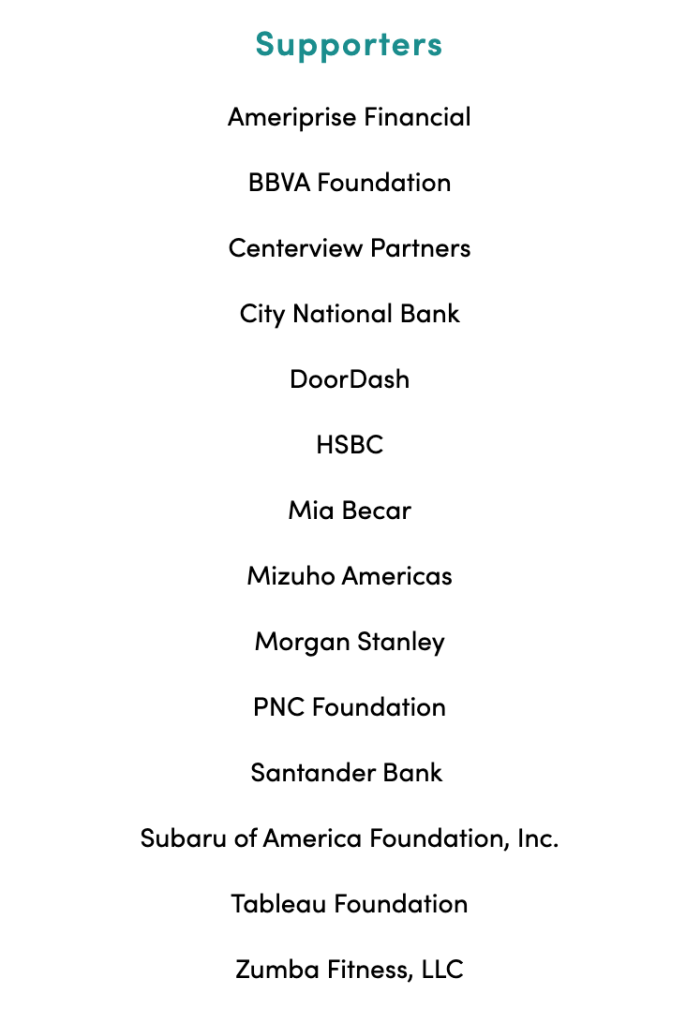

Grameen America is one of Grameen’s most successful projects in the world. There are various reasons why Grameen America can perfectly replicate the model in Bangladesh. One of the most important reasons is that Grameen America has four direct sources of funding: large fund companies, financial institutions, family funds, and individual donations. For example, in 2019, Wells Fargo Bank donated $400000 and $7.5 million in credit funds to Grameen America, which helped approximately 2500 low-income women. In the United States, Grameen’s development has met many like-minded people. “I don’t want anything that would in any way undermine what has been a tremendous model.” Former US President Bill Clinton once publicly expressed his approval of Grameen’s design logic.

In addition, Grameen China is actively breaking through the difficulties under the bank cooperation system. Mr. Ma said Grameen is trying to communicate with the institution, which is currently collaborating, to develop loan products that are more suitable for Grameen. This product can ensure a fast lending process and can be independently operated by Grameen’s team. “It is expected to be put into use within the next two months.” Mr. Ma said. However, this requires both parties to reach a consensus on the concept of granting loans, which is a long-term negotiation process.

Also, Mr. Gao Zhan has been working hard to develop more partners. This year, Mr. Gao Zhan led a team to Bangladesh to inspect and learn Grameen’s classic model. There were nine executives from a bank in the team. Fortunately, this visit directly led to cooperation – Grameen China will empower this bank and provide consulting and training to cooperative banks to transfer Grameen’s classic model.

Afterward, Mr. Gao Zhan will continue to wander around banks in various parts of China in search of suitable bank leaders.

Grameen also plans to find some public welfare investments in the future and establish its own funding system. Currently, Ningbo Shanyuan Foundation has established the Yunus Inclusive Finance Special Fund for Grameen China, opening up a donation channel for Grameen China’s cause.

Overall, Mr. Gao Zhan is confident in the future development prospects of Grameen China but also feels powerless. In his words, “Many Grameen members have experienced great changes in their finances, children’s education, and social connections. Therefore, I believe that as we continue to improve, the Grameen model will be completely replicated. The future has unlimited potential.”

After such a long period of exploration, Grameen China has well practiced its belief in embracing the immutability of finance and making the world a more equal place. As a manager from Grameen Ankang said, in Grameen, members are not anyone’s wife or mother’s daughter; they are just themselves, independent and strong individuals. They are seen and supported in Grameen, where they inspire the power to change themselves, their families, and even the world.

“I saw a slogan in Bangladesh in a grassroots office of Grameen, signed by Professor Yunus, and the content was ‘You are my warrior; your mission is to eliminate human poverty.’ This sentence impressed me,” said Mr. Gao Zhan. “Many stories about Grameen inspire me, and I am willing to fight for Grameen’s mission.”

I believe that in the future, with the unremitting efforts of the Grameen China team and support from all walks of life, Grameen will continue to firmly support female entrepreneurship, help other groups connect to the world, and create more moving stories.

Reference: